Are you feeling undervalued and underpaid? Do you think you deserve a salary increment? We understand how you feel, and we’re here to help. In this article, we will guide you on how to ask for a hike, what factors to consider, and how Healthysure can help you in the process. We know that your time is valuable, so let’s get started!

Salary increments, which can provide employees with the necessary financial support to meet their needs and improve their quality of life. In this article, we will discuss everything you need to know about hikes, including what they are, why they matter, how to calculate salary hike percentage and how to negotiate them.

Table of Contents

What is a Salary Hike?

A salary hike, also known as a pay raise or salary increment, is an increase in an employee’s salary. This increase is usually provided on an annual basis and is based on various factors, including employee performance, inflation rates, industry standards, and the company’s financial situation.

Why Salary Hikes Matter

According to a survey, India is projected to have the highest average hike in the Asia Pacific (APAC) region in 2023, with a projected increase of 10 percent. Hikes are essential for several reasons. For starters, they provide employees with a sense of financial stability, which can help reduce their stress levels and improve their quality of life. Additionally, hikes can increase an employee’s motivation to perform better and achieve their career goals. They also demonstrate that the company values its employees and is willing to invest in their well-being.

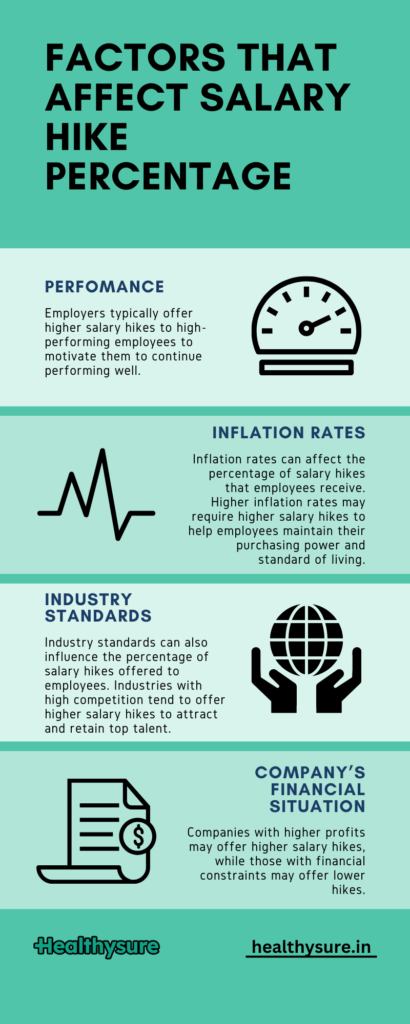

Factors that Affect The Hike Percentage

With a growing career, you are right to expect salary increment every now and then. The percentage of raise that an employee receives can depend on various factors, including the following:

- Performance: Employee performance is a critical factor that determines the percentage of raise. Employers typically offer higher raise to high-performing employees to motivate them to continue performing well.

- Inflation Rates: Inflation rates can affect the percentage of hikes that employees receive. Higher inflation rates may require higher hikes to help employees maintain their purchasing power and standard of living.

- Industry Standards: Industry standards can also influence the percentage of hikes offered to employees. Industries with high competition tend to offer higher hikes to attract and retain top talent.

- Company’s Financial Situation: The company’s financial situation is also a critical factor that affects the percentage of hikes. Companies with higher profits may offer higher raise, while those with financial constraints may offer lower raise.

Asking for a Salary Raise

Prepare Your Case

Before you ask for a salary raise, you need to prepare your case. This means gathering data and facts to support your request. Here are some things to consider:

- Gather information about the industry standard salary for your position and experience level.

- Make a list of your accomplishments and contributions to the company.

- Highlight any additional responsibilities you have taken on.

Example:

Let’s say you work as a marketing manager and you have been with the company for three years. You have increased the company’s revenue by 20% and implemented successful marketing campaigns. You have also taken on additional responsibilities such as managing the social media accounts and training new employees. You can use this information to support your case for a raise.

Timing is Key

Timing is crucial when it comes to asking for a hike. It’s important to pick the right time to make your request. Here are some things to consider:

- Wait until you have completed a major project or achieved a significant accomplishment.

- Avoid asking for a hike during a company-wide crisis or financial downturn.

- Consider asking for a hike during your performance review or when you are negotiating a new contract.

Example:

Let’s say you have just completed a successful marketing campaign that has generated a lot of revenue for the company. This would be an excellent time to ask for a hike because you have a strong case and you have just demonstrated your value to the company.

Be Confident and Professional

When asking for a hike, it’s important to be confident and professional. Here are some things to keep in mind:

- Practice your pitch and be prepared to answer any questions or objections.

- Be respectful and avoid making demands or ultimatums.

- Show appreciation for your employer and express your commitment to the company.

Example:

Let’s say you have scheduled a meeting with your boss to discuss a raise. You can start the conversation by expressing your gratitude for the opportunity to work at the company and highlighting your accomplishments. Then, you can explain why you believe you deserve a hike and present the data and facts you have gathered to support your request. Make sure to listen to your boss’s feedback and be open to negotiation.

How to Approach for Salary Hikes at Different Stages of Your Career?

The approach to hikes can vary depending on where you are in your career. Here are some tips to consider:

- Early Career: At the start of your career, it’s essential to focus on gaining experience and building your skills. Hikes may not be as significant at this stage, but it’s important to negotiate a fair starting salary.

- Mid-Career: In the middle of your career, you may have more experience and skills to leverage for hikes. Focus on building a strong case for why you deserve a hike and negotiate for a fair increase based on industry standards.

- Late Career: As you approach the end of your career, you may want to consider negotiating for other benefits besides a hike, such as flexible working hours, part-time work, or reduced responsibilities. This can help you achieve a better work-life balance and transition into retirement.

Factors to Consider

When considering a hike, there are several factors to take into account. Here are some things to consider:

Market Trends

One of the most important factors to consider is market trends. It’s essential to research the industry standard salary for your position and experience level. This information can help you determine whether your salary is competitive and whether you should ask for a salary raise.

Example:

Let’s say you work in software engineering and have three years of experience. You can research the average salary for software engineers with three years of experience in your area and compare it to your current salary. If you’re earning below the average, you may have a strong case for a hike.

Company Finances

Another factor to consider is the company’s finances. If the company is experiencing financial difficulties or is going through a restructuring, it may not be the right time to ask for a salary hike. However, if the company is doing well financially, it may be more open to the idea of giving out hikes.

Example:

Let’s say you work for a startup that has just received a new round of funding. This would be an excellent time to ask for a salary raise because the company has more financial resources and may be more willing to invest in its employees.

Job Performance

Your job performance is another important factor to consider. If you have been consistently performing well and have achieved significant accomplishments, you may have a strong case for a hike.

Example:

Let’s say you work in sales and have consistently exceeded your sales targets for the past year. You can use this information to support your case for a hike because you have demonstrated your value to the company.

Understanding Appraisal Cycles

Appraisal cycles are a crucial aspect of raises. They are the period during which employees are assessed based on their performance and contributions to the organization. Most organizations follow a yearly appraisal cycle, where employees are evaluated at the end of the year. However, some companies may have a bi-annual or quarterly appraisal cycle.

During an appraisal cycle, employees are assessed based on their performance, contributions, and achievements during the period under review. The appraisal results are then used to determine the salary raise, bonus, and other benefits that the employee is eligible for.

Simplify your salary hikes and employee benefits with us to achieve financial stability and well-being.

Bonuses: A Key Factor in the Hike

Bonuses are an essential aspect of raises. They are additional payments that employees receive, usually at the end of the year or on special occasions. Bonuses are a way of rewarding employees for their hard work, dedication, and contributions to the organization.

Bonuses can be of different types, such as performance-based bonuses, project-based bonuses, or company-wide bonuses. Performance-based bonuses are given to employees who have exceeded their targets or achieved exceptional results. Project-based bonuses are given to employees who have contributed significantly to a particular project or initiative. Company-wide bonuses are given to all employees as a token of appreciation for their overall performance.

CTC: A Comprehensive Approach to Salary Hike

CTC, or Cost to Company, is a comprehensive approach to hike that takes into account all the components of an employee’s compensation package. CTC includes not only the employee’s salary but also other benefits, such as bonuses, medical insurance, retirement benefits, and other perks.

CTC is an essential factor in hikes as it gives employees a comprehensive view of their compensation package. Understanding CTC can help employees make informed decisions about their salary negotiations and plan their finances better.

Understanding the hike calculator

Salary hike calculator

Calculate new salary

Formula used :

Calculate hike percentage

Formula used :

A salary hike calculator is a tool that helps employees in calculating the salary increment (estimated) based on their performance and contributions. The calculator takes into account various factors, such as the employee’s current salary, the appraisal rating, the company’s salary increment or raise policy, and the industry standards.

Using a hike calculator online can help employees plan their finances and set realistic expectations for their raise. It can also help employees understand the factors that contribute to their raise and take steps to improve their performance and contributions.

How to calculate salary hike percentage of an employee?

How to calculate salary increase percentage? In addition to the factors that affect the percentage of salary hikes, it’s also essential to know how to calculate the salary hike percentage for an employee. Here’s the percentage calculation formula :

- Determine the Current Salary: The first step is to determine the employee’s current salary.

- Determine the Proposed Salary: The next step is to determine the proposed salary. This could be a percentage increase or a fixed amount.

- Calculate the Difference: Subtract the current salary from the proposed salary to get the difference.

- Divide by Current Salary: Divide the result by the current salary while multiplied by 100 to get the percentage increase.

For example, let’s say an employee’s current salary is INR 50,000, and the proposed salary is INR 60,000. The difference is INR 10,000, and the percentage increase in the salary is calculated with the following calculation formula :

(10,000 / 50,000) x 100 = 20%

Therefore, the salary increase percentage for this employee is 20%.

How Healthysure Can Help

At Healthysure, we not only offer a range of employee benefits to help you stay healthy and financially secure, but we can also help you take advantage of tax benefits that come with these benefits. For instance, our group health insurance plans can help your business save on taxes through premium deductions, as well as help employees save on taxes through reimbursements and deductions for individual health insurance premiums and medical expenses.

Furthermore, by providing comprehensive employee benefits through Healthysure, you can increase the overall compensation package for your employees. This can lead to increased job satisfaction, employee retention, and even attract new talent to your business. Our financial wellness program can also help your employees better manage their finances, which can help reduce financial stress and increase productivity.

So, whether you’re looking to save on taxes or increase employee satisfaction, Healthysure has you covered. With our range of employee benefits, including health insurance, dental insurance, vision insurance, and wellness programs, we can help you and your employees succeed both professionally and personally.

Conclusion

At Healthysure, we understand that a competitive salary and employee benefits play a significant role in achieving financial stability and job satisfaction. That’s why we offer personalized coaching and a range of customized employee benefits, including health insurance, wellness programs, retirement plans, mental wellness benefits, flexible working hours, and more.

To make it easy for employees to access their benefits, we offer an easy-to-use portal and comprehensive support. Our goal is to help our clients achieve their financial goals and improve their overall well-being by offering a holistic approach to employee benefits and personalized coaching.

Get affordable and customisable plans to secure your team

We believe that by providing customized solutions that cater to our clients’ unique needs, we can help them achieve financial stability and job satisfaction. At Healthysure, we strive to offer the best possible solutions and support to help our clients navigate any doubts or concerns they may have about their benefits.

We hope that this guide has been helpful, and we wish you the best of luck in your salary increment negotiations!

FAQs

What is the average salary hike percentage?

The average salary hike percentage can vary depending on various factors, including the employee’s performance, industry standards, and the company’s financial situation. Typically, salary hikes range between 5-15%, but it can be higher or lower based on these factors.

How often should I negotiate a hike?

It is recommended to negotiate a salary raise annually during the performance review process. However, you can also negotiate for a specific percent hike in salary if you have taken on additional responsibilities or achieved significant milestones.

How do employee benefits impact employee retention?

Employee benefits play a significant role in employee retention as they provide a sense of financial security and support. When employees feel valued and supported, they are more likely to stay with their employer long-term.