Claims management can be difficult. The patient is not the only one who suffers; his family and friends are also going through a difficult period. They are concerned not just about whether or not the patient receives drugs and attention on time, but also about the high cost of medical care. Health insurance policies serve as a financial support system for many people during difficult times.

However, submitting claims for health insurance is usually thought to be a difficult and lengthy process. Your loved one is having treatment and undergoing testing, but instead of being present for them, you are occupied filling out health claims forms and lining up the necessary paperwork. Or maintaining other documentation while you’re not feeling well.

Healthysure has kept this in mind and made simple attempts to make your trip into the world of health insurance as smooth as possible by streamlining the claims procedure for you.

Table of Contents

Understanding the Claim Management Process

Claim management is the process of managing insurance claims from the time a claim is made until it is resolved. The process involves documenting the claim, reviewing policy coverage, assessing damages, and negotiating settlements. A well-managed claim can make the difference between a hassle-free insurance process and a prolonged, frustrating one.

Why is claims management important? Claim management is critical to the success of an insurance process, as it helps insurers manage risk, prevent fraud, and maintain customer satisfaction. By managing claims effectively, insurers can reduce the cost of claims, improve the speed of resolution, and ensure that policyholders receive the compensation they are entitled to.

General Insurance Claims Vs. Health Insurance Claims

In general, claims mean to claim or assert possession of something, or to affirm something as true. According to Investopedia, a health insurance claim is a formal request by a policyholder to an insurance company for compensation in response to a covered loss or policy occurrence. After analysing the claim, the insurance company either validates or refuses it. If it is authorised, the insurance company will pay the insured or an authorised interested party on the insured’s behalf.

When it comes to insurance claims, you’ve probably heard of two terms: Cashless Claims and Reimbursement Claims.

Claims without cash

Let’s look at a simple example to better comprehend cashless claims. Mrs. Shende has a health insurance policy and has chosen cashless insurance as part of her health insurance plan. So, if she is hospitalised, she can receive cashless care at any hospital that has a contract with her insurance carrier. Mrs. Shende only needs to notify her insurer three to four days before her admission and fill out a pre-authorization form to use her cashless services. What if Mr. Sharma has an emergency, an unexpected treatment? How will he notify his insurer in advance? In the event of an emergency, a rapid notification to the insurance will suffice, and the pre-authorization form must be completed within 24 hours of his admission.

To conclude, with cashless claim settlement, policyholders can receive medical treatment at a network hospital without having to pay out of pocket during their stay.

Claims for Reimbursement

When you are treated at a non-network hospital or choose not to use cashless benefits under your health plan, reimbursement claims are filed. To further grasp the concept of reimbursement claims, consider two examples from Mr. Patel’s and Mr. Gandhi’s life.

Mr. Patel has health insurance and has decided to seek treatment for a condition covered by his coverage at a network facility. However, unlike Mrs. Shende, he had decided not to opt for cashless benefits while acquiring his coverage.

As a result, Mr. Patel informed the insurer ahead of time and paid for the treatment he received at the network hospital out of his own pocket. He did, however, file a reimbursement claim with his insurer after being discharged from the hospital. He produced receipts and medical bills as proof of his medical expenses, and the insurance company reimbursed Mr. Patel for the full amount of his medical expenses when his claim was approved. This was an illustration of a reimbursement claim settlement for treatment at a network hospital. Let’s see how it goes when you go to a non-network hospital for treatment.

Mr. Gandhi, who also has health insurance, was hospitalised at a non-network facility due to an emergency. Because he is now receiving treatment at a hospital with which his insurance company has no affiliation, he would not be eligible for cashless hospitalisation because the benefit is only available at network hospitals. As a result, when he was discharged from the hospital, he had to pay for the whole cost of his treatment out of his own money. However, after being discharged from the hospital, Mr. Gandhi filed a reimbursement claim with the insurer, including original medical reports, bills, and the Discharge Certificate, or Discharge Summary. As soon as his claim was accepted, the insurance company compensated him for the entire amount. To summarise, non-network hospitals are not eligible for cashless claims.

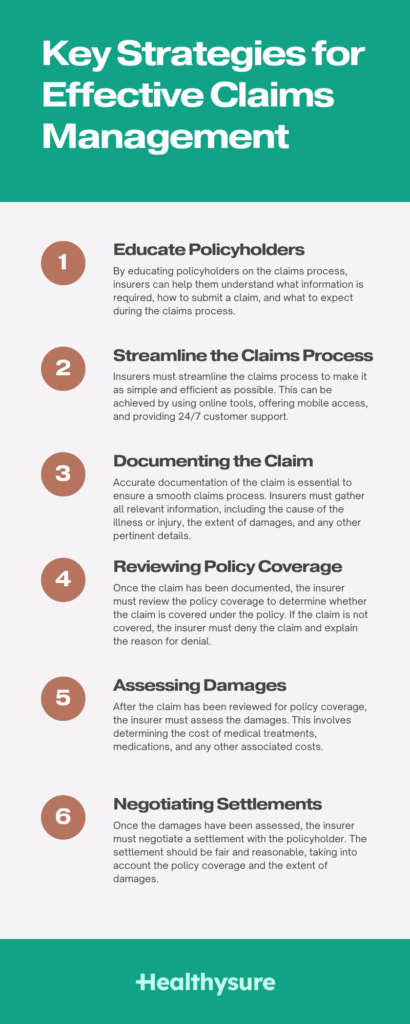

Key Strategies for Effective Claims Management

- Educate Policyholders: One of the most important strategies for effective claim management is to educate policyholders on the claims process. By educating policyholders on the claims process, insurers can help them understand what information is required, how to submit a claim, and what to expect during the claims process.

- Streamline the Claims Process: Insurers must streamline the claims process to make it as simple and efficient as possible. This can be achieved by using online tools, offering mobile access, and providing 24/7 customer support.

- Documenting the Claim: Accurate documentation of the claim is essential to ensure a smooth claims process. Insurers must gather all relevant information, including the cause of the illness or injury, the extent of damages, and any other pertinent details.

- Reviewing Policy Coverage: Once the claim has been documented, the insurer must review the policy coverage to determine whether the claim is covered under the policy. If the claim is not covered, the insurer must deny the claim and explain the reason for denial.

- Assessing Damages: After the claim has been reviewed for policy coverage, the insurer must assess the damages. This involves determining the cost of medical treatments, medications, and any other associated costs.

- Negotiating Settlements: Once the damages have been assessed, the insurer must negotiate a settlement with the policyholder. The settlement should be fair and reasonable, taking into account the policy coverage and the extent of damages.

Benefits of Effective Claims Management

- Reduced Costs: Effective claim management can reduce the cost of claims by streamlining the claims process, identifying fraudulent claims, and preventing unnecessary medical treatments.

- Improved Customer Satisfaction: By managing claims effectively, group health insurers can improve customer satisfaction by resolving claims quickly and efficiently.

- Better Risk Management: Effective claim management can help insurers manage risk by identifying potential risks and taking steps to mitigate them.

Hospitals on and off the network

A hospital that is part of an insurance company’s network is referred to as a network hospital. This partnership between the hospital and the insurance company allows patients with health insurance policies from that particular insurance company to receive medical treatment at the hospital without having to pay upfront. Instead, the insurance company will cover the medical expenses incurred during the treatment, subject to the terms and conditions of the policy. This is known as cashless care, as the patient does not have to pay any money out of their pocket at the time of treatment.

On the other hand, non-network hospitals are those that do not have a partnership with any insurance company. Patients who visit these hospitals and have health insurance policies will have to pay for their medical treatment upfront and then claim reimbursement from their insurance company. This process can be time-consuming and sometimes complicated, as insurance companies may require specific documentation to process the reimbursement claim.

Things to keep in mind while submitting a claim

When you are busy caring for a loved one or yourself in the hospital, it is easy to overlook items needed to file a health insurance claim. So, to assist you in remembering all of the necessities while filing a health insurance claim, we have designed a checklist to ensure you don’t miss anything and have a smooth claim settlement free of last-minute surprises.

Documents Needed

Paperwork is undoubtedly the most time-consuming aspect of any procedure, but what if you have a list of essential documents? Isn’t it easier to align the documents without missing any? Naturally, it will be. So, we’ve created a checklist for you that you can take note of.

- Pre-approval form for medical bills

- Medical documentation

- The insured’s ID must be valid.

- a duplicate of the insurance policy bond

- Cheque cancelled

Aside from the paperwork listed above, your insurance company may have other document requirements that you should be aware of. So, while purchasing an insurance policy, make sure to obtain a list of the documents required to file a health insurance claim.

Timetables

As previously stated, there is a deadline for submitting the pre-authorization form for making a cashless claim. In the case of planned treatment, the pre-authorization form should be filed three to four days in advance, however in the case of an emergency, the form should be submitted within 24 hours of admission.

If the timelines are not fulfilled, the claim may be delayed, resulting in a delay in treatments if you choose a cashless claim.

A list of hospitals that are linked together

Cashless claim settlement is only possible if treatments are received in a hospital affiliated with the insurance carrier. Assume you have an emergency and want to file a cashless claim, but you are unfamiliar with the network hospitals. What are your plans? You cannot afford to put off therapy.

The best you can do is keep a list of network hospitals on hand in case of an emergency or in general. In the event of an emergency, request that your insurer give you with a list of network hospitals so that you do not have to wait or lose time.

Maximum Sum Insured

Health insurance claims are limited to the amount insured. The sum insured is the maximum annual value that your insurance company will pay if you are hospitalised. Any amount in excess of the amounts insured must be paid out of your own pocket.

For example, suppose your sum insured is two lacs and you are hospitalised twice in one year. If your hospital cost was 1.5 lacs in the first event and 70 thousand in the second, your total hospital expense for the year will be 2.2 lacs. Because the total amount exceeds the sum covered, the insurance company will pay 2 lacs of the total price, with the insured covering the remaining 20 thousand.

Since we’re talking about health insurance limits, you should be aware of room rent and ICU limits.

When selecting a health insurance policy, consider the room rent limit and ICU charges. Room rent is usually set at 1% or 2% of the money insured per day, and ICU rates typically double that, at 2% or 4% of the sum insured.

Exemptions

Exclusions are situations in which the insurance provider refuses to offer coverage. As a result, claims for those exclusions will be denied by the insurance company.

Exclusions in health coverage include war-related injuries, HIV, intentional injuries, congenital disorders, and so on. These may not be the same for all insurance companies or health insurance policies. To minimise surprises throughout the claims process, you should review all of your health coverage’s exclusions before enrolling in a health plan.

Another feature of health insurance claims is the waiting period, which varies depending on the situation.

- Four years of waiting

When purchasing health insurance, if the insured indicates that he has pre-existing ailments such as high blood pressure, diabetes, thyroid, and so on, the insurance company requires medical tests to determine the severity of the diseases on the policyholder. For example, if Mrs. Shende has diabetes, she will have to take a test for the insurance company, and the insurer will decide on the waiting period based on the results. Typically, the waiting period is four years. This means that any hospital-related expenses related to pre-existing diseases can only be claimed with the insurance after 4 years. It is sometimes advised to obtain health insurance coverage early in life in order to minimise waiting periods. - 1-2 years of waiting

On specific conditions such as ENT disorders, osteoporosis, hernia, non-infectious Arthritis, Cataract, Hemorrhoids, Fissure, and so on, the policyholder often has a one to two year waiting time. As a result, claims for specific conditions can only be filed after a 1-2 year waiting period. Make sure you understand your insurer’s waiting time.

Having trouble managing claims for your team? Let Healtysure handle them for you!

How Healthysure Can Help?

Healthysure can help you with claims.

It is critical to understand your health insurance in order to trust it and make an informed selection. Healthysure makes certain that you understand everything about your health plan, insurance claims, and answers all of your questions.

If you find filing claims hard, we have a step-by-step approach for making both cashless claims and reimbursement claims for your convenience. So you don’t get bogged down in paperwork or face any surprises during an emergency.

Not to add, if you have any questions about your health plan at any time of day, Healthysure’s 24X7 assistance will answer them all for you.

Get your health plan from Healthysure for your team if you want a simple claims process and a straightforward health insurance policy.

Conclusion

Effective claim management is critical to the success of a group health insurance plan, as it helps insurers manage risk, prevent fraud, and maintain customer satisfaction. By following the key strategies for effective claim management, insurers can reduce the cost of claims, improve the speed of resolution, and ensure that policyholders receive the compensation they are entitled to. By implementing these strategies, group health insurers can enhance their claim management process, resulting in a hassle-free insurance process for all parties involved.

FAQs

What is the role of reviewing policy coverage in claim management?

Reviewing policy coverage is important to determine whether the claim is covered under the policy. If the claim is not covered, the insurer must deny the claim and explain the reason for denial.

How does a cashless claim work?

To avail a cashless claim, the policyholder must be treated at a hospital that is empaneled with the insurance company. The policyholder must provide their insurance policy details to the hospital, and the hospital will then send a pre-authorization request to the insurance company. Once the request is approved, the policyholder can avail of the medical treatment without making any upfront payment.

How does a reimbursement claim work?

To avail a reimbursement claim, the policyholder must pay for the medical treatment upfront and then submit the bills and other relevant documents to the insurance company for reimbursement. The insurance company will then verify the claim and reimburse the policyholder for the approved expenses.